A New Standard For The Issuance Of Private Securities Is Emerging Within The Capital Markets

On May 16th 2019 a community of the London-based investors, financial intermediaries and private companies gathered in Thomson Reuters building for the “Investments in Tokenised Securities” event held by HighCastle, the UK blockchain-based share registrar and investment marketplace, in partnership withRefinitiv, a world-leading provider of financial markets data and infrastructure built from the former Thomson Reuters Financial and Risk business. Refinitiv’s Sustainable Investing & Fund Ratings division is led by Leon Saunders Calvert, who is also a member of HighCastle’s Advisory Board.

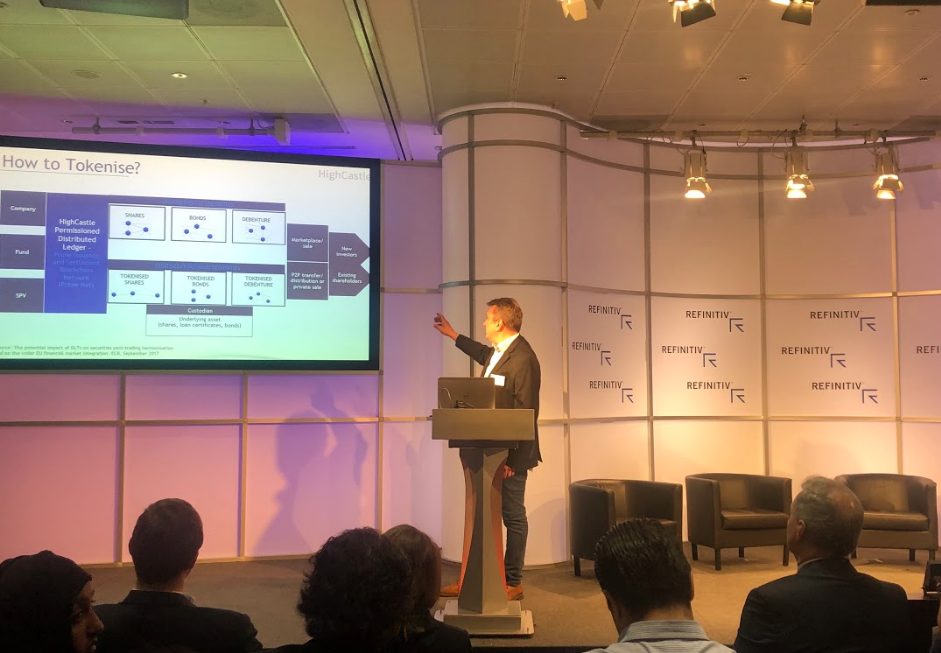

Philip Millar, Executive Director at HighCastle presented the blockchain-based infrastructure of the HighCastle’s Platform, which includes HighCastle Prime Issuance, Registry and Settlement Blockchain Network (Prime Net), HighCastle Prime Market for initial offering of private securities, HighCastle Multi-Trade for multi-exchange trading and HighCastle Market Data. He also elaborated on the legal implications and business advantages of tokenised securities for investors, financial intermediaries and issuers. He highlighted that for public or private company, it’s been legal to issue non-paper/electronic/digital shares for decades. Now after the breakout of Distributed Ledger Technology (DLT) the company can move equity and loan records to a blockchain-based registry and benefit from the latest developments within the capital markets infrastructure.

The Issuer, a corporate body, may take the decision to issue securities in a digital form and keep the electronic registry of shareholders/debtholders though the distributed ledger (blockchain). Upon issuance of private transferable securities these can be traded on regulated trading venues, including MTFs.

Investments in private securities in a digitally wrapped form on the distributed ledger allows investors to utilise the benefits of public capital markets with even greater efficiency – enhanced liquidity of private securities, 24/7 market access, near real-time settlement, automated dividends/interest payments, embedded compliance, cryptographically secure digital wallets, cost reduction and easy follow-on rounds.

Investments in private securities in a digitally wrapped form on the distributed ledger allows investors to utilise the benefits of public capital markets with even greater efficiency – enhanced liquidity of private securities, 24/7 market access, near real-time settlement, automated dividends/interest payments, embedded compliance, cryptographically secure digital wallets, cost reduction and easy follow-on rounds.

Ulyana Shtybel, Vice President and Chief Capital Officer at HighCastle walked the audience through an online demo of HighCastle functionality and presented two use cases of digital securities offering covering documentation and the subsequent issuance of digital securities.

Ulyana Shtybel, Vice President and Chief Capital Officer at HighCastle walked the audience through an online demo of HighCastle functionality and presented two use cases of digital securities offering covering documentation and the subsequent issuance of digital securities.

Ulyana elaborated on HighCastle’s insights regarding the legally compliant offering, subscription, issuance, distribution and management of securities in a digitally wrapped form (known as security tokens, smart securities or digital securities).

In her demo, she presented HighCastle Prime Market, a market for private securities within a regulatory framework dedicated to the needs of smaller companies. Issuance of securities in a digital (tokenised/electronic) form on the HighCastle’s permissioned blockchain (Prime Net) is conducted by the Issuer in convenient manner through the Issuer Hub available at HighCastle Platform – my.highcastle.co

Upon completion of the Issuance Form, HighCastle’s Compliance Officer approves the electronic issuance provided all issuance and security’s details are true in accordance to the necessary legal documents, including Statement of Capital or other document issued by local authority confirming registration of the current issuance and Subscription and Shareholders’ Agreement.

Once approved by HighCastle’s Compliance Officer, a new series of digital securities with the indicated parameters are automatically generated and become available in the issuer corporate account, from where the issuer can distribute it to investors’/shareholders’ accounts as well as seamlessly view the company securities records in the blockchain-based register available in the Platform’s Issuer Hub. The registry of shareholders and holders of debentures can be printed out by Issuer anytime and provided to authorities upon request.

During the event Balázs Klemm, CFA, Founding Partner at blufolio AG has presented the goals and investment criteria of the Blufolio VC which is focused on tokenised securities with the targeted liquidity event in 18-36 months after the primary offering of securities by portfolio companies.

Blufolio is planning to fundraise on the HighCastle platform for its Luxembourg-issued fund, which will provides access to a diversified basket of carefully-selected blockchain startups and is open to qualified investors globally.

The event was concluded by the Panel Discussion: Should investors be pushing private securities into a digital format?, moderated by Ulyana Shtybel.

The event was concluded by the Panel Discussion: Should investors be pushing private securities into a digital format?, moderated by Ulyana Shtybel.

The panelists Leon Saunders Calvert, Head of Sustainable Investing & Fund Ratings at Refinitiv, Luca Zurlo, Managing Partner at Voluntres VC, Philip Walsh, Regulatory Compliance Director at HighCastle agreed on the following market visions:

The panelists Leon Saunders Calvert, Head of Sustainable Investing & Fund Ratings at Refinitiv, Luca Zurlo, Managing Partner at Voluntres VC, Philip Walsh, Regulatory Compliance Director at HighCastle agreed on the following market visions:

(1) Tokenised securities could become the acceptable and recognised form of issuance for private companies overnight, once such a deal has been executed by one of the big investment banks.

(2) Legality of tokenised securities is not anymore under doubt once you understand the role of the blockchain as the book-entry share registry (cryptographically secure distributed database versus spreadsheets).

(3) Clarifications from Regulators would be useful but not necessary as blockchain-based registry fits well within the existing legal framework.

(4) Use of blockchain in a private capital market is not a disruptor for the market players rather it is an evolution of the capital market infrastructure.

(5) Transferability of private securities issued in a digital form is one of the biggest advantages of tokenisation we will see becoming a reality in the next 3 years.

HighCastle is organising the events on the tokenised securities almost every month to educate investors and issuers about the advantages of the blockchain-enabled investment process and issuance of tokenised securities. “This approach allows us to prepare the market, as from 2020-2021 digital securities issued on the distributed ledgers might begin to operate as a new standard for issuance of private securities”- mentioned Ulyana Shtybel, Vice President at HighCastle.

About HighCastle

HighCastle is the UK share registrar and investment marketplace, which provides the end-to-end blockchain-based technological infrastructure and legal framework for compliant issuance, distribution, management and smooth trading of private securities.

About Refinitiv

Refinitiv is a world-leading provider of financial markets data & infrastructure built from the former Thomson Reuters Financial & Risk business.